Follow the Money: An Introduction to Payments

A series designed to help you master and gain a deep understanding of the payment ecosystem.

Stripe acquired stablecoin startup Bridge on 11/22/2024 for $1.1 billion, making a bold bet on stablecoins.

What’s going on? Are stablecoins the future of payments or a hype cycle? To what extent are they going to change the payment landscape?

The truth is, no one can predict the future. But informed opinions, rooted in a solid understanding of the payments ecosystem, are statistically better than random guesses—and that’s where FsEngine comes in.

If you Google "how payments work," you’ll likely find a high-level overview of card payments. Useful? Maybe. Comprehensive? Not even close.

This article serves as an introduction to our "Understanding Payments" series, offering an overview of the key topics we’ll explore. As an introductory piece, it won’t dive deeply into any single topic but aims to set the stage for the series. If you’re new to payments, this serves as a starting point. Most material will be familiar to those already experienced in the field but could still provide a fresh perspective on the bigger picture.

Payment Methods: Overview

A payment is the exchange of value between a payer and a beneficiary, such as businesses or individuals, using various methods.

Cash Payments: Physical currency, including banknotes and coins. Despite increasing digitization, cash remains a dominant payment method in many countries.

Paper-Based Payments: Traditional instruments like checks, are becoming less common but still relevant in certain regions.

Bank Payments: Transactions made through bank accounts, such as wire transfers and ACH (Automated Clearing House) payments.

Card Payments: Transactions using debit, credit, or prepaid cards, supported by card networks like Visa and Mastercard.

Digital Payments: Payments where money exists purely in digital form. While most modern money is represented digitally, the distinction here is legal rather than technical.

Blockchain-Based Payments: Transactions utilizing cryptocurrencies, stablecoins, or other blockchain technologies.

In this series, we will focus on fintech-relevant payment methods, excluding cash and paper-based payments. While cash remains widely used in many parts of the world, these methods are typically outside the scope of fintech innovations.

Bank Payments

Understanding bank payments is key to making sense of other payment methods. Systems like cards, digital wallets, and alternative payment methods all rely on the underlying infrastructure of bank payments.

At its core, a bank operates by keeping a ledger of what it owes to depositors—essentially, a record of your money. A bank account is just that: an entry in the ledger showing what the bank owes you. For simplicity, let’s assume banks don’t lend money in this example, meaning every dollar they owe you is fully backed by cash.

Payments between customers of the same bank are pretty simple—just a quick update to the ledger. Things get trickier when money needs to move between different banks. That’s where the central bank comes in. It’s the hub of the payment network, where all banks (directly or through correspondents) hold accounts. These accounts are used to settle payments between banks, forming the backbone of today’s payment systems.

Payment frameworks

Payment frameworks are regulated networks that allow banks to exchange standardised messages about transactions and settle funds efficiently.

Building a payment messaging system is far more complex than handling casual messages like those on WhatsApp. Payments involve money, requiring robustness, security, and reliability to prevent losses or fraud. Additionally, most payment systems are built on legacy architectures designed decades ago, making modernization challenging due to their deep integration with financial institutions, regulatory frameworks, and operational processes. This complexity, though cumbersome, has ensured their reliability in supporting the global economy.

Each currency typically has its payment systems, connecting the central bank to all participating banks. For instance, if Alice had an account at ING Direct in the Netherlands and Bob at Kommerz Bank in Germany, a €10 transfer could look like this.

Our series on “Understanding Payments” will break down diagrams like the one above delving into the core components of modern payment infrastructures, helping you make sense of the systems and standards that power transactions worldwide. We will explore batch payments, real-time payments, direct debit payments, and high-value transactions for the major payment schemes used by the world’s key currencies, such as SEPA for EUR, Fedwire and ACH for USD, CHAPS for GBP or CIPS for CNY. We will look at how these systems rely on key elements such as Real-Time Gross Settlement Systems (RTGS) for immediate settlement of critical transactions, payment frameworks for batch and instant payments, messaging standards to enable secure and standardized communication, and clearing houses to process and reconcile payment instructions before settlement.

We will also cover Open Banking, a regulatory and technological framework that allows third-party providers to access financial data and services from banks with the customer's consent promoting competition and enhancing customer experience.

Finally, we will examine the latest developments in the payment ecosystem, such as Wero, to shed some light on future developments.

Cross-Border Payments

Cross-border payments involve transferring funds between parties in different countries. They are far more complex because domestic payment systems have evolved independently across countries and they were not built to communicate with each other - as if they were speaking different languages.

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is the backbone of cross-border payment messaging, providing a secure and standardized communication network for banks globally. While SWIFT doesn’t move money itself, it coordinates transactions through Nostro and Vostro accounts and enables currency conversions. Despite its role in improving global banking connectivity, reliance on correspondent banks and pre-funded accounts contributes to high costs and slow transaction speeds.

This inefficiency (together with the associated revenue margins), has paved the way for new solutions. Early pioneers like Western Union simplified cross-border P2P remittances, while modern fintechs like Wise (B2C) and Airwallex (B2B), Payoneer (B2B), and Stripe Treasury (B2B) provide faster, more cost-effective alternatives. Additionally, infrastructure providers like Thunes offer low-cost, efficient currency corridors, further challenging traditional SWIFT-based systems.

We will elaborate on all of the above topics in our dedicated articles.

Card payments

Bank payments weren’t built for real-time transactions, like paying at a shop, which is where card payments came in. They make things easy for users, but behind the scenes, there’s a complex system that’s often expensive and takes time to settle payments.

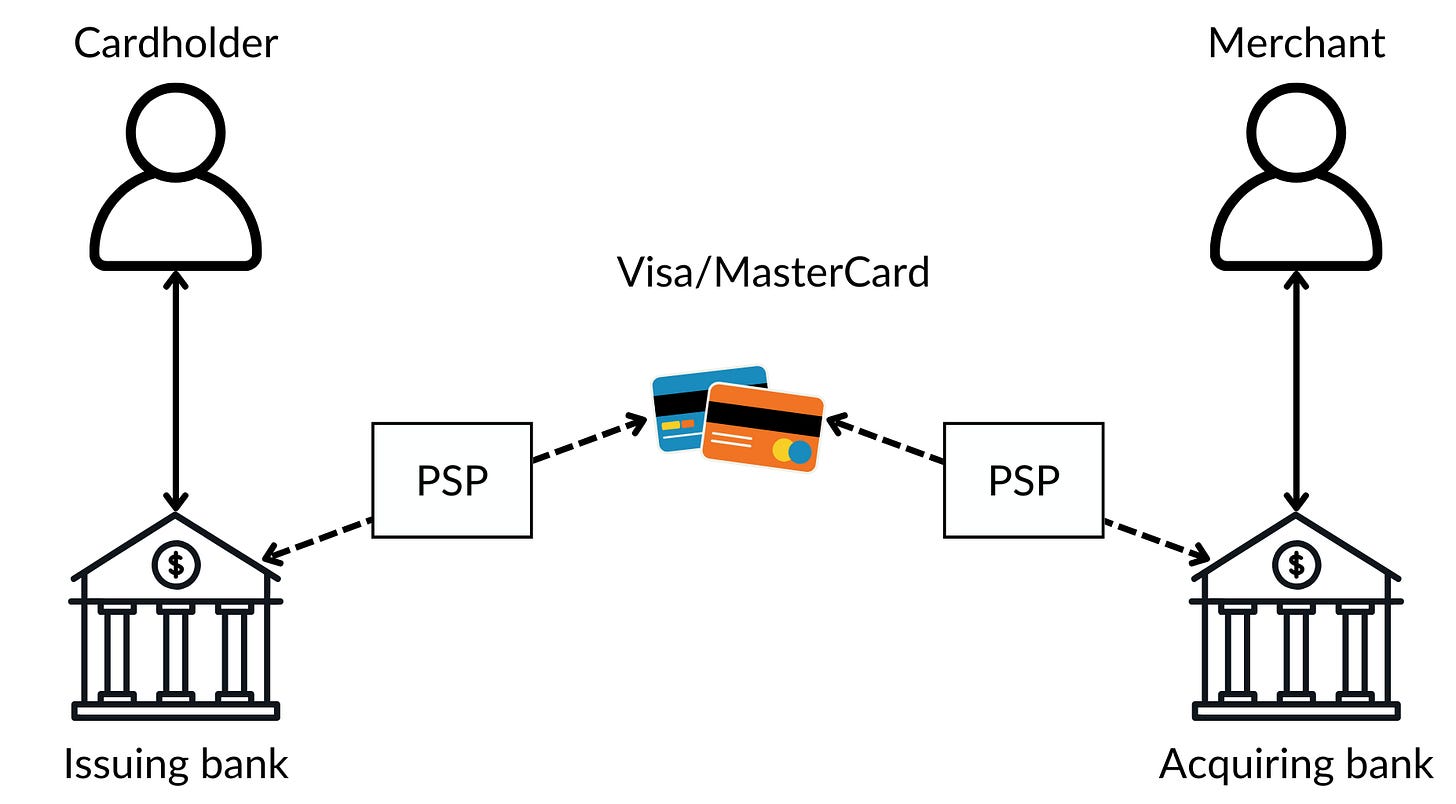

How Card Payments Work

At a very high level, card payments work as follows.

Transaction Initiation:

The cardholder initiates a payment at a POS terminal or online. The merchant sends the payment request to the acquiring bank via a payment processor and card network (e.g., Visa, Mastercard).Authorization:

The card network forwards the request to the issuing bank, which verifies the cardholder’s details, checks funds or credit, and temporarily holds the amount. An approval or decline is sent back to the merchant.Clearing:

The acquirer batches approved transactions and sends them to the card network for reconciliation between the issuer and acquirer.Settlement:

The issuer transfers the transaction amount (minus fees) to the card network, which routes it to the acquirer. The acquirer deposits funds into the merchant’s account within 1–3 business days.Fees:

Fees deducted include interchange fees (to the issuer), network fees (to the card network), and processing fees (to the payment processor). These fees support the system's operation.

Card payments operate on top of the banking infrastructure, effectively serving as an instant clearing mechanism. Their key innovation lies in decoupling clearing (i.e. “confirming” the payment) from the settlement (actually sending the money), allowing for instant payment authorization—a crucial feature, especially for online transactions.

In our series, we will explore card payments in greater depth.

The process is costly, with high fees for merchants, leading to the rise of alternative payment methods that address these challenges.

Alternative Payment Methods (APMs)

Both bank payments and card payments face challenges in speed, user experience (UX), cost, and security. Alternative Payment Methods (APMs) have emerged to tackle these issues by leveraging modern technology to create better networks and more efficient services.

In this "Understanding Payments" series, we will explore the breakthroughs made by APMs, how they work, and what the future holds for them.

APMs Focused on Peer-to-Peer (P2P) Payments

Some APMs simplify and reduce the cost of instant P2P payments by bypassing traditional banking and card networks.

Bizum (Europe): Enables instant, free transfers using only the recipient’s phone number, eliminating the need for account details.

Venmo (US): Offers fast, free P2P transfers with an integrated social component, making payments more engaging.

APMs Focused on Merchant Transactions

Other APMs aim to lower merchant fees and reduce reliance on card networks by creating closed payment ecosystems:

PayPal (US): Originally developed for online purchases without requiring a credit or debit card, now expanded to offer other financial services.

Satispay (Europe): Supports in-store payments within a closed network, significantly reducing merchant costs.

These systems create closed networks that are cheaper to operate, appealing to merchants seeking to reduce transaction fees. The principle is simple - parties (individuals or businesses) have an account with the APM which holds funds at a bank. The advantage is that the APM is usually more technologically advanced than the bank.

Digital Wallets: Security and Convenience

Digital wallets like Google Pay and Apple Pay are also APMs. They enhance the security and convenience of payments by tokenizing card details, reducing the risk of fraud.

Key Features:

Allow payments via phone without revealing card numbers.

Remove the need for physical cards during in-person purchases.

Enable secure online transactions by storing card details safely on devices.

Limitations:

These wallets still rely on traditional card networks, offering improved UX for users without reducing underlying costs.

Other APMs and embedded finance

In addition to global APMs, we’ll examine local payment methods designed to interface with governments and authorities, further expanding the ecosystem of alternatives.

We will also look at how APMs leverage APIs to allow organisations to embed financial products in their offerings.

Blockchain-based payment methods

Last but not least, we will delve into blockchain payments. On top of a section in our “Understanding Payment series”, we will also have a whole “Understanding the blockchain series”.

Cryptocurrencies are digital currencies built on blockchain technology. They enable the exchange of value programmatically, relying solely on code to validate transactions. This has two key implications:

Elimination of Third Parties: Transactions occur directly between parties without the need for intermediaries like central banks or payment processors.

Monetary Exchange as Data Flow: Payments can be treated as programmable data, unlocking new possibilities for financial innovation, such as conditional payments, micropayments, streaming payments and decentralized financial services.

How it started and how it’s going

Crypto payments began as a way to bypass central banks and government intervention, eliminating risks like currency devaluation through monetary policy. However, this freedom comes with challenges. The lack of regulation can be a double-edged sword—it avoids interference but also limits governments’ ability to enforce critical controls like anti-money laundering (AML) or stabilize economies during crises.

Ironically, despite their decentralized nature, the transparency of major blockchains makes them relatively easy to track and regulate. Today, the crypto space is becoming increasingly regulated. Crypto-native companies are securing licenses, and traditional financial institutions are integrating crypto into their compliance programs.

The rise of stablecoins—blockchain-based representations of fiat currencies like the US dollar—introduces a fascinating dynamic. Private organizations are essentially issuing a more accessible version of government money on a public blockchain, offering the dollar on a more efficient, programmable infrastructure.

How will this evolve? In our upcoming blockchain payments articles, we’ll dive into:

The benefits of blockchain, such as programmable smart contracts and a harmonized infrastructure for cross-border payments.

Its limitations compared to traditional systems.

Licensing, AML and KYC requirements, data privacy, security, and consumer protection.

The crypto landscape is multifaceted, and opinions are often polarized between uncritical advocates and staunch skeptics. We aim to provide a balanced perspective—exploring the opportunities crypto unlocks, its current limitations, and how this space continues to evolve.

The road ahead

Payments is a vast and complex topic, with enough depth to fill several books on each aspect covered in this article. In our series, we aim to gradually explore these topics, providing in-depth and practical insights to help you build a comprehensive understanding of the payment ecosystem, empowering you to navigate its intricacies with confidence and clarity. Whether you're a professional in the industry or simply curious about how payments work, this series will serve as a valuable guide to demystify the world of payments.